Understanding Elasticity: How Market Demand Reacts to Price and Income Changes

Understanding Elasticity: How Market Demand Reacts to Price and Income Changes

Elasticity is a fundamental concept in economics that measures the responsiveness of the quantity demanded of a good to changes in its price or consumers' income. It provides valuable insights into how consumers adjust their purchasing behavior in response to economic variables, influencing business strategies and policy decisions. This article delves into the concept of elasticity, focusing on price elasticity of demand and income elasticity of demand, and their implications for markets.

Price Elasticity of Demand

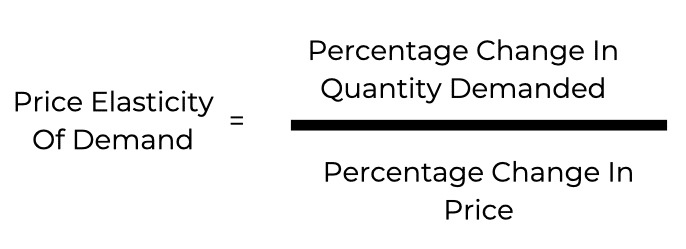

Price elasticity of demand (PED) quantifies the degree to which the quantity demanded of a good changes in response to a change in its price. It is calculated using the following formula:

Categories of Price Elasticity

- Elastic Demand (PED > 1): When the percentage change in quantity demanded is greater than the percentage change in price. Consumers are highly responsive to price changes.

- Example: Luxury goods, such as designer handbags, often exhibit elastic demand. A small decrease in price can lead to a significant increase in quantity demanded.

- Inelastic Demand (PED < 1): When the percentage change in quantity demanded is less than the percentage change in price. Consumers are less responsive to price changes.

- Example: Essential goods, like insulin for diabetics, typically have inelastic demand. Even significant price changes do not drastically alter the quantity demanded.

- Unitary Elasticity (PED = 1): When the percentage change in quantity demanded is equal to the percentage change in price. Total revenue remains constant when the price changes.

- Example: A hypothetical good where a 10% price increase results in a 10% decrease in quantity demanded, maintaining the same total revenue.

Determinants of Price Elasticity of Demand

- Availability of Substitutes: Goods with many substitutes tend to have more elastic demand. Consumers can easily switch to alternatives if the price rises.

- Example: The demand for butter is elastic because margarine can be used as a substitute.

- Necessity vs. Luxury: Necessities tend to have inelastic demand, while luxuries are more elastic.

- Example: The demand for electricity is inelastic as it is essential for daily living, whereas the demand for high-end electronics is more elastic.

- Proportion of Income: Goods that take up a larger proportion of a consumer's income tend to have more elastic demand.

- Example: Housing costs are more elastic compared to the demand for inexpensive items like salt.

- Time Horizon: Demand elasticity can vary over time. In the short term, demand is often more inelastic because consumers need time to adjust their behavior.

- Example: The demand for gasoline is more inelastic in the short term but can become more elastic over time as consumers switch to more fuel-efficient cars or alternative transportation.

Income Elasticity of Demand

Income elasticity of demand (YED) measures how the quantity demanded of a good changes in response to a change in consumers' income. It is calculated as:

Categories of Income Elasticity

- Positive Income Elasticity (YED > 0): Indicates a normal good, where demand increases as income rises.

- Example: Demand for organic food increases with higher income.

- Negative Income Elasticity (YED < 0): Indicates an inferior good, where demand decreases as income rises.

- Example: Demand for generic brand groceries may decrease as consumers opt for branded products when their income increases.

- Income Elasticity Greater Than One (YED > 1): Indicates a luxury good, where demand increases more than proportionately as income rises.

- Example: Demand for luxury cars and high-end vacations significantly increases with higher income.

Implications of Income Elasticity

- Economic Growth: In periods of economic growth, normal and luxury goods see a significant increase in demand. Businesses catering to these segments benefit from higher sales and can adjust their marketing strategies to target affluent consumers.

- Recession: During economic downturns, the demand for inferior goods rises as consumers shift to cheaper alternatives. Companies producing such goods can capitalize on this shift by highlighting value-for-money in their marketing campaigns.

Practical Applications of Elasticity

Business Pricing Strategies

Understanding elasticity helps businesses set optimal prices. For products with elastic demand, businesses might lower prices to increase total revenue, while for inelastic products, they can raise prices without significantly reducing sales volume.

Government Policy

Governments use elasticity to predict the effects of taxation and subsidies. For goods with inelastic demand, such as tobacco, higher taxes can significantly increase revenue without greatly reducing consumption. Conversely, subsidies on goods with elastic demand, like renewable energy technologies, can greatly boost adoption rates.

Revenue Management

Companies can use elasticity to manage revenue and inventory. By analyzing demand elasticity, firms can anticipate changes in sales volumes due to price adjustments or economic shifts, helping them maintain optimal inventory levels and maximize revenue.

Conclusion

The concept of elasticity is crucial for understanding how markets react to changes in prices and income. By analyzing price elasticity of demand, businesses and policymakers can make informed decisions that enhance market efficiency and consumer satisfaction. Similarly, understanding income elasticity provides insights into consumer behavior in different economic conditions, allowing businesses to adapt their strategies to changing economic landscapes. In essence, elasticity not only helps predict market reactions but also guides effective decision-making in both private and public sectors.