Mergers and Acquisitions: Key Strategies for Finance Majors

Mergers and acquisitions (M&A) are among the most dynamic and impactful aspects of corporate finance. These strategies shape industries, create global conglomerates, and redefine competition. For finance majors, understanding the intricacies of M&A is essential for excelling in coursework and preparing for careers in investment banking, corporate strategy, or consulting. This comprehensive guide explores the key strategies behind M&A, offering practical insights for students seeking assignment help.

What Are Mergers and Acquisitions?

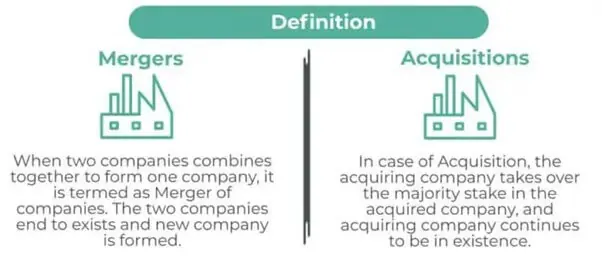

Definition

- Mergers: The combination of two companies into one entity to achieve synergies, reduce costs, or expand market reach.

- Acquisitions: The purchase of one company by another, either through mutual agreement or hostile takeover.

Importance in Corporate Finance

M&A transactions are pivotal in reshaping business landscapes. They are used to:

- Achieve growth and diversification.

- Strengthen competitive positions.

- Unlock operational and financial synergies.

Key Types of Mergers and Acquisitions

1. Horizontal Mergers

- Description: Occurs between companies operating in the same industry or market.

- Example: Two competing retailers merging to consolidate market share.

- Benefits: Reduces competition, expands customer base, and achieves economies of scale.

2. Vertical Mergers

- Description: Combines companies operating at different stages of the supply chain.

- Example: A manufacturer acquiring a supplier to ensure raw material availability.

- Benefits: Improves supply chain efficiency and reduces production costs.

3. Conglomerate Mergers

- Description: Brings together companies from unrelated industries.

- Example: A technology firm merging with a consumer goods company.

- Benefits: Diversifies business risks and opens new markets.

4. Hostile Takeovers

- Description: An acquisition attempt that bypasses the target company’s board of directors.

- Example: A company acquiring shares directly from the market or shareholders.

- Challenges: Faces resistance from the target company, potentially leading to legal disputes.

Key Strategies in Mergers and Acquisitions

1. Identifying Synergies

M&A deals aim to unlock synergies, where the combined entity delivers greater value than the sum of its parts.

- Operational Synergies: Cost savings from shared resources and processes.

- Revenue Synergies: Increased sales through cross-selling and market expansion.

2. Valuation Techniques

Determining the fair value of a target company is crucial for a successful M&A deal.

- Discounted Cash Flow (DCF): Projects future cash flows and discounts them to present value.

- Comparable Company Analysis: Evaluates the target company relative to industry peers.

- Precedent Transactions: Analyzes previous M&A deals in the same industry.

3. Due Diligence

Before proceeding with an M&A deal, companies conduct thorough due diligence to identify potential risks.

- Financial Due Diligence: Reviews the target company’s financial health, liabilities, and assets.

- Legal Due Diligence: Ensures compliance with regulations and uncovers potential legal disputes.

- Operational Due Diligence: Evaluates the target company’s operations, infrastructure, and workforce.

4. Integration Planning

Post-merger integration is critical for realizing synergies and achieving strategic goals.

- Cultural Integration: Aligning organizational cultures to prevent clashes.

- System Integration: Merging IT systems, processes, and workflows.

- Communication: Ensuring transparency with stakeholders and employees.

Challenges in Mergers and Acquisitions

- Valuation Disputes: Overestimating synergies or underestimating liabilities can lead to overpaying for the target company.

- Cultural Clashes: Differences in corporate culture can disrupt operations post-merger.

- Regulatory Hurdles: Compliance with antitrust laws and regulatory approvals can delay or block deals.

- Integration Failures: Poor planning can result in missed synergies and operational inefficiencies.

Role of M&A in Career Opportunities for Finance Majors

1. Investment Banking

- Involves advising companies on M&A transactions, conducting valuations, and structuring deals.

2. Corporate Finance

- Focuses on evaluating potential M&A opportunities, performing financial analysis, and managing integration.

3. Consulting

- Provides strategic advice on M&A planning, due diligence, and post-merger integration.

Tips for Excelling in M&A Assignments

1. Master Valuation Models

Understand key valuation techniques like DCF, comparable company analysis, and precedent transactions.

2. Analyze Case Studies

Study real-world M&A deals to gain insights into strategies, challenges, and outcomes.

3. Leverage Financial Tools

Use tools like Microsoft Excel, Bloomberg, and online calculators for accurate financial modeling.

4. Stay Updated

Follow news on recent M&A deals to understand trends and industry practices.

5. Collaborate

Work in teams to analyze complex M&A cases and share diverse perspectives.

Online Resources for Student Help

- Coursera: Offers courses on M&A strategies and financial modeling.

- Investopedia: Simplifies M&A concepts and valuation techniques.

- Harvard Business Review: Provides articles and case studies on successful M&A deals.

- EssayResearchScholar.com: Offers personalized assignment help for finance majors.

Conclusion

Mergers and acquisitions are transformative strategies that demand a deep understanding of valuation, integration, and financial analysis. For finance majors, mastering these concepts is essential for excelling in assignments and preparing for impactful careers.

This guide provides a robust foundation for tackling M&A assignments, offering insights into strategies, challenges, and real-world applications. With tools like EssayResearchScholar.com and other online resources, students can navigate complex M&A topics confidently and build expertise in this critical area of corporate finance.